Featured

Pv Tax Shield Formula

Pv Tax Shield Formula. The difference in taxes represents the interest tax shield of company b, but we can also manually calculate it with the formula below: These are the tax benefits derived from the creative structuring of a financial arrangement.

Interest tax shield = interest expense deduction x effective tax rate. (i think that it is also not from summing geometric sequence.) So, for instance, if you have $1,000 in mortgage interest and your tax rate is 24 percent, your tax shield will be $240.

Tax Shield = Sum Of Tax.

Most importantly, we model explicitly the risk of the tax shield and the debt with. The tax shield on interest is positive when earnings before interest and taxes, i.e., ebit, exceed the interest payment. For individuals.tax rate is primarily used for interest expense and depreciation expense in the case of a company.

A Tax Shield Is A Reduction In Taxable Income For An Individual Or Corporation Achieved Through Claiming Allowable Deductions Such As Mortgage Interest , Medical Expenses , Charitable.

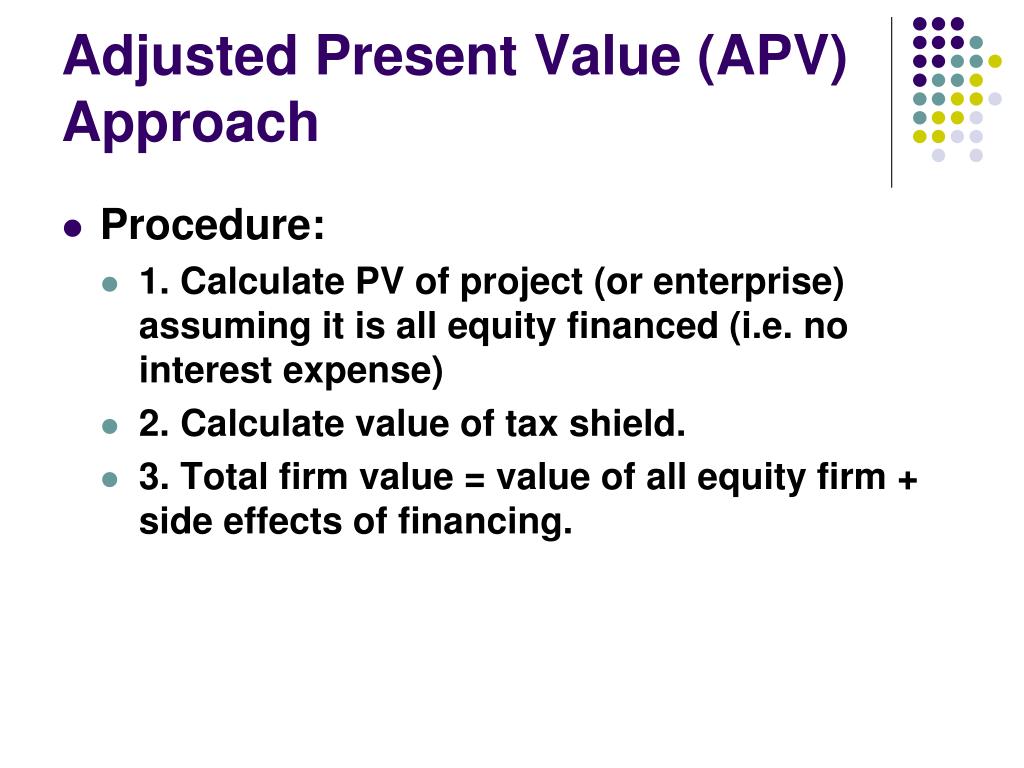

How to calculate tax shield due to depreciation. The adjusted present value is the net present value (npv) of a project or company if financed solely by equity plus the present value (pv) of any financing benefits. In the line for the initial cost.

In Kaplan Afm Textbook, The Issue Cost Was Added To The Amount To Be Raised When Calculating The Tax Shield On The Loan And The Subsidy Benefit But Upon Solving The Past Questions I’ve Seen They Don’t Add The Issue Cost To The Amount Of.

Present value of total tax shield from cca for a new asset acquired after november 20, 2018 =. Interest tax shield = $4m x 21% = $840k. These are the tax benefits derived from the creative structuring of a financial arrangement.

Under Such An Approach, Cash Taxes Are Treated Like Any Other Cash Flow Since The Tax Saving Are Embedded Within Effective Tax Rate.

Present value (pv) tax shield formula; A tax shield is an allowable deduction from taxable income that results in a reduction of taxes owed.tax shield can be claimed for a charitable contribution, medical expenditure etc. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

Pv Ts = ∑ I = 1 N K C Bt 1 + K E I E28.

Present value pv tax shield formula. (1) the formula includes “ ” that comes from tax shield savings. This model is similar to harris and pringle or kaplan and ruback model because the cost of equity is used as a discount factor, assuming book value instead of market value.

Popular Posts

Derivative Of Newton Forward Difference Formula

- Get link

- X

- Other Apps

Comments

Post a Comment